Among certain regulations, the brand new FHA’s “100-Kilometer Rule” will stands out as the such as for example difficult to own borrowers. Unfamiliar to the majority of homeowners, there are two main 100-mile statutes, for every having its very own ramifications and needs.

Inside writings, we are going to explore these two regions of the fresh 100-Kilometer Code, working out for you know the way they might effect your own FHA financing sense.

Desk of Articles

- 100-Distance Code for getting an extra FHA Mortgage

- 100-Distance Laws For rental Earnings

- How-to Qualify for an enthusiastic FHA Financing

- Option Financing to possess Homebuyers Influenced by the fresh 100-Kilometer Rule

- Faq’s (FAQs) About FHA Financing plus the 100-Kilometer Signal

- The bottom line

100-Distance Code for finding the next FHA Loan

An important requirement listed here is point: while moving in to own employment along with your brand new home are Plattsville bad credit loans more than 100 far away from your own latest house, you can also meet the requirements to hold a new FHA loan.

not, navigating that it part of the rule isn’t simple. It will take large research, for example documents of the moving reasons, the length involving the old and brand new residences, and your agreements into very first property.

100-Mile Rule For rent Earnings

Right here, new FHA states that when you are moving and you may planning rent out your latest household, new local rental earnings can simply qualify in your the mortgage certification in case your new house is more than 100 miles away.

This laws is made to prevent individuals by using FHA financing to get multiple features for rental intentions without having tall collateral inside.

This may pose a critical difficulties if you find yourself relocating lower than 100 far as they are with respect to the local rental money off their past home to be eligible for an alternate loan.

Brand new limit is designed to maintain the stability off FHA funds, making certain these are typically used mostly for personal residences in lieu of strengthening a beneficial home portfolio.

Each other aspects of the fresh 100-Distance Signal are designed to end the brand new punishment of FHA financing. It be sure such fund suffice its priilies pick the primary houses.

But not, getting individuals who’re legally moving in and need to handle numerous properties, this type of laws can add levels out of difficulty on the financing processes.

How exactly to Qualify for an FHA Loan

When it comes to protecting an enthusiastic FHA mortgage, you will find some tips to look at. Insights these can make it easier to influence eligibility and get ready for the fresh app processes.

Credit history and you can Downpayment

Typically, consumers you need the absolute minimum credit rating from 580 to help you be eligible for brand new FHA’s low-down payment advantage, that’s currently during the step 3.5%.

When your credit score try between 500 and you can 579, you may still be considered, however, a more impressive % down payment away from 10% may be required.

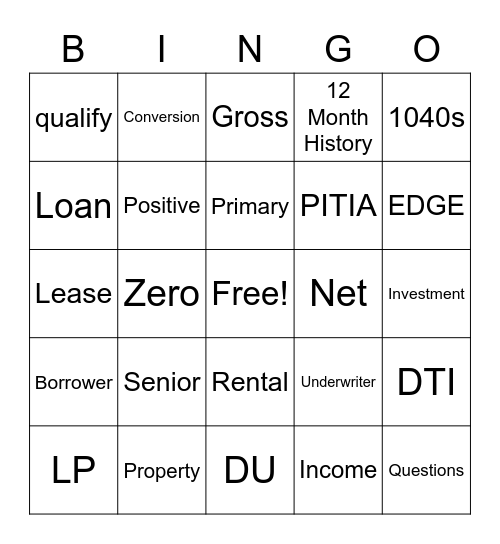

Debt-to-Money Ratio (DTI)

FHA guidance generally require an effective DTI proportion away from 43% otherwise quicker, however, there are times where borrowers which have highest DTI ratios is also be approved, specifically having compensating situations.

Home loan Insurance policies

That have an enthusiastic FHA loan, you must pay money for mortgage insurance. Including an initial home loan top (UFMIP) and you can a yearly advanced split up into monthly payments. This insurance rates protects the lending company in case of debtor standard.

A position Record and Income Balances

FHA loans require consumers to possess a reliable employment record and you may income. Loan providers normally pick a-two-seasons functions background, in the event latest graduates or people who have a legitimate reason behind a position gaps might still meet the requirements.

Assets Requirements

The home you need to buy having a keen FHA loan need to meet specific safety, safeguards, and you can architectural integrity conditions. A keen FHA-accepted appraiser have to examine the home to be sure it meets these criteria.

Solution Financing for Homeowners Impacted by the 100-Distance Signal

The new FHA’s 100-Distance Rule can also be establish a significant challenge for some potential housebuyers. However, you will need to just remember that , it is not the end of the latest street. You will find several solution financing possibilities that can help you achieve your family-to find specifications.