- Low-down payment choice: It’s a common misconception that you should build a beneficial 20% advance payment in order to qualify for a conventional financing. The minimum downpayment for a conventional financing is 3%, meaning you could establish as low as step three% of your own home’s value so you’re able to meet the requirements. But not, understand that you will be accountable for purchasing personal financial insurance rates (PMI) for individuals who set out less than 20%. Whatever the case, these types of fund create homeownership economical and versatile for the ideal type of borrowers.

- Available for different types of property: Which have a normal mortgage, you can aquire certain assets systems, ranging from number 1 and you can secondary to help you trips homes and funding attributes.

- Preferred by sellers: Particular vendors try to avoid consumers having fun with government finance with tight possessions criteria and can take longer in order to procedure. Whenever you are authorities-backed finance are typically just as effortless since the old-fashioned money, this new seller’s impact of one’s loan variety of make a difference a borrower’s capacity to get a home.

- Potentially lesser to close: Old-fashioned money avoid initial fees of the a number of other mortgage items, leading them to possibly cheaper to close off.

Traditional Financing versus. Non-Conventional Funds

The best definition of a normal financing are people loan you to isn’t supported by the federal government. Types of low-antique funds become FHA, Virtual assistant, and you may USDA money, all of which try backed by different authorities providers. These are also types of low-conforming finance, definition they don’t satisfy Fannie mae and Freddie Mac’s assistance to have pick, so they really can’t be obsessed about the second financial market.

Non-Certified Mortgages (Non-QM loans) also are a kind of low-traditional mortgage. Because the antique fund are qualified, definition they conform to specific assistance to make certain value, Non-QM financing is actually technically maybe not antique fund.

While they’re given by personal loan providers, Non-QM financing usually do not qualify becoming noticed accredited mortgage loans. As an alternative, they’ve been a type of non-compliant loan that differs from a traditional conventional loan.

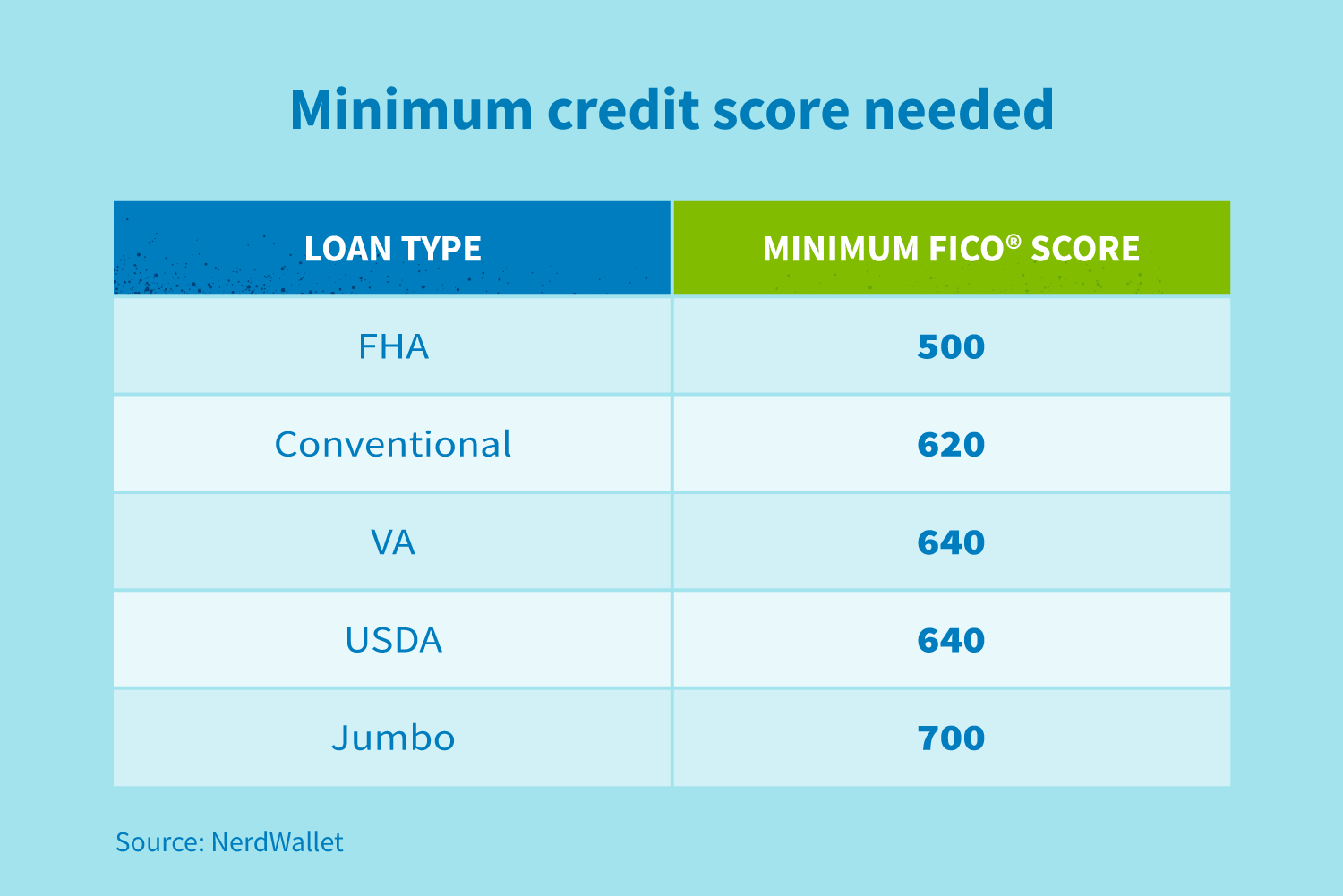

Each type away from low-antique financing has its own group of credit conditions, so it’s significantly different from the following. Overall, you can find differences in criteria when it comes to another:

- Type of borrower

- Down money

- Credit ratings

- Debt-to-income (DTI) percentages

- Rates of interest

Let’s glance at each of the other low-traditional mortgage versions in order to recognize how they range from old-fashioned fund.

Va finance

Antique finance are available to individuals, while you are Va funds are merely accessible to eligible productive responsibility provider players, experts, and you will surviving partners. Va loans don’t need a down payment, allowing you to receive 100% financial support. While doing so, they allow for down credit ratings and you will highest DTI ratios.

FHA funds

FHA loans be versatile with respect to qualification requirements, enabling consumers for you could try here credit scores only five hundred and off repayments of step 3.5%. Obviously, these wide variety will vary. For example, you just be considered having a four hundred credit score if you’re able to be able to make a down payment out-of 10%. With the help of our flexible lending standards, it’s no wonder FHA money try a greatest replacement conventional funds having earliest-go out customers.

As compared to traditional loan conditions, which permit to possess off costs as low as step 3%, FHA finance need lower fico scores in order to qualify, to make homeownership so much more available. Remember that one another style of funds has insurance rates if you will be making a reduced deposit.

Which have FHA loans, you’ll need to spend a home loan insurance premium (MIP) once you create a deposit away from less than ten%. Monthly MIP costs up coming persevere for the whole life of the new financing, in spite of how far equity you generate at home.